Customer Acquisition Cost (CAC) is a critical metric for businesses seeking to optimize their marketing and sales efforts. Understanding the average CAC by industry helps companies to benchmark their performance and devise strategies to improve profitability. In this article, we’ll explore the average CAC across industries and discuss what constitutes a good CAC, how to calculate it, and strategies to improve this vital metric.

What is the Average Customer Acquisition Cost by Industry?

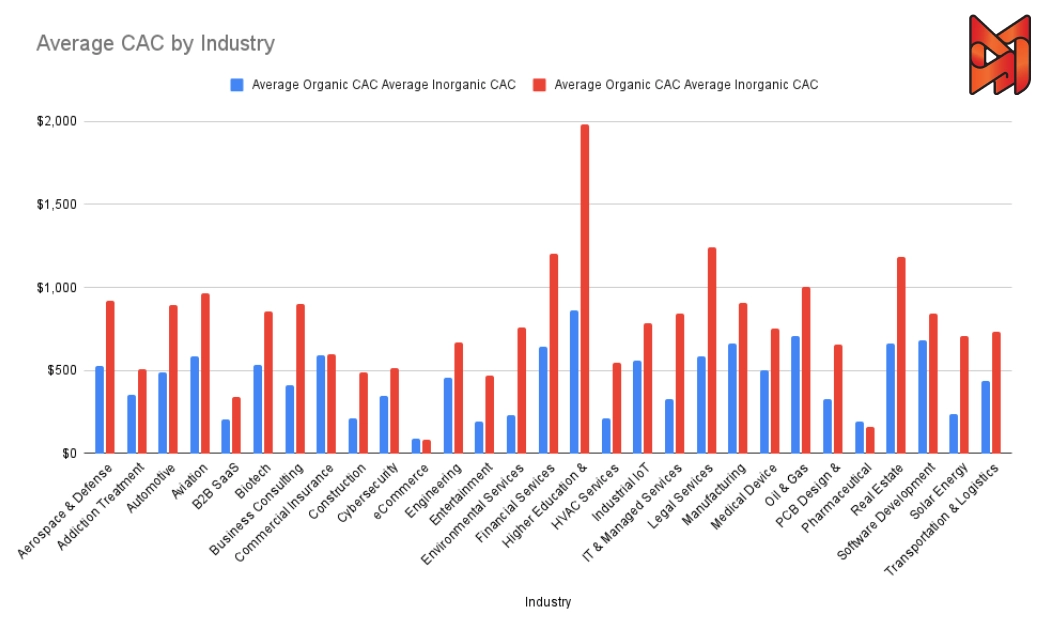

CAC varies significantly by industry due to differences in customer lifecycles, marketing expenses, and competition levels. Below, we provide a detailed breakdown of the average CAC for ten industries, complete with insights and strategies for improvement:

- eCommerce: The average customer acquisition cost ranges between $30 and $100. For instance, niche online stores often experience lower CAC due to focused targeting, while larger retailers may face higher costs as they compete in broader markets. Case studies, such as that of a mid-sized apparel brand reducing its CAC by 20% through optimized retargeting ads, highlight the importance of using data-driven strategies. If you want to learn more about ecommerce marketing tips, read our article on this topic.

- SaaS (Software as a Service): SaaS companies generally have an average CAC between $200 and $1,000. Enterprise-level SaaS providers, such as Salesforce, often incur higher costs due to extended sales cycles and the need for specialized account managers. Smaller SaaS startups, however, have demonstrated success in lowering CAC by using inbound marketing and community engagement.

- Mobile Apps: CAC for mobile apps averages $2 to $4 per install, but user acquisition costs can soar when focusing on high-value or long-term users. For example, a gaming app might spend $30 per engaged user but achieve a positive ROI by introducing subscription models. App developers often succeed by utilizing partnerships with ad networks and app stores for visibility.

- Healthcare: The average customer acquisition cost is about $285, influenced by outreach efforts and patient acquisition through digital campaigns. For example, a local clinic in Los Angeles reduced its CAC by 35% by focusing on patient testimonials and leveraging Google My Business for local SEO.

- Education: Educational institutions, with CAC ranging from $500 to $1,200, often require multi-touch campaigns. A case study from a regional university highlights how hosting virtual open days and employing alumni as brand ambassadors helped lower their CAC by 15% while increasing application rates.

- Retail: Retail businesses see an average customer acquisition cost of $10 to $40. A boutique retailer in New York City managed to cut CAC by integrating loyalty programs and running limited-time social media offers, demonstrating the effectiveness of combining customer retention with acquisition efforts.

- Travel and Tourism: CAC in this sector can range from $30 to $200. A travel agency specializing in luxury vacations effectively used influencer partnerships to lower their CAC while significantly improving customer engagement. Seasonal discounts and experiential marketing further enhanced their results.

- Financial Services: With CAC ranging from $175 to $300, financial service providers often successfully reduce costs by prioritizing education. For instance, a fintech startup offering free financial literacy webinars saw a 20% drop in their CAC and increased customer trust.

- Real Estate: CAC averages $200 to $500 due to high transaction values and lengthy customer journeys. A Chicago real estate agency reduced its CAC by leveraging virtual reality tours and interactive property listings, enhancing customer experiences and reducing the need for multiple physical showings.

- Hospitality: Hotels and restaurants spend approximately $100 to $300 per customer acquisition. Case studies show how incorporating AI-driven pricing models and personalized email marketing campaigns can lead to substantial CAC reductions, particularly during off-peak seasons.

Including detailed case studies and comparisons like these ensures businesses can align their strategies with industry-specific benchmarks and proven tactics.

What is a Good CAC?

A good CAC depends on the industry and is largely determined by the Customer Lifetime Value (CLV). Achieving an optimal CLV-to-CAC ratio—generally at least 3:1—is key. For example, if your CAC is $100, your customer should ideally generate $300 or more in lifetime revenue. However, industries with lower profit margins, such as retail, might settle for a 2:1 ratio.

Here’s how businesses in different industries can work toward achieving the ideal CLV-to-CAC ratios:

- eCommerce: Focus on upselling and cross-selling opportunities. Personalized product recommendations and loyalty programs can help increase customer lifetime value while managing acquisition costs.

- Focus on improving website UX to boost conversion rates.

- Use remarketing ads to bring back potential customers.

- Analyze customer behavior to create personalized marketing campaigns.

- SaaS: Concentrate on customer retention by improving user onboarding and offering tiered subscription plans. Regular engagement, such as webinars or email campaigns, can prevent churn and maximize revenue from each user.

- Healthcare: Use patient follow-ups and offer value-added services like wellness programs or telehealth options. This enhances patient loyalty, contributing to a higher CLV.

- Education: Use referral programs to bring in new students. Long-term strategies, such as maintaining relationships with post-graduation students, can yield higher lifetime engagement and donations.

- Retail: Implement loyalty cards and reward points. Encourage repeat purchases through exclusive discounts and seasonal promotions, creating a stronger emotional connection with the brand.

- Travel and Tourism: Offer discounted bundles for repeat travelers or memberships for frequent flyers. Introducing loyalty schemes like hotel points or exclusive early-bird discounts can significantly improve customer retention and value.

- Financial Services: Provide personalized financial advice or premium accounts with extra benefits. Educational content about financial products can also create trust, making customers more likely to engage with higher-value services over time.

- Real Estate: Establish a long-term relationship by offering property management or additional services post-sale. Regular updates about market trends can also keep customers engaged.

- Mobile Apps: Encourage in-app purchases or subscriptions by offering limited-time offers or exclusive features for loyal users. A seamless user experience will foster engagement, boosting CLV while reducing churn.

- Social media ads and influencer marketing are popular but can quickly drive up customer acquisition costs.

- App developers can reduce customer acquisition costs by optimizing for App Store visibility and encouraging word-of-mouth referrals.

- Hospitality: Promote repeat visits through loyalty programs, such as offering free stays or meal vouchers after a certain number of visits. Seasonal discounts and personalized travel packages can also enhance customer loyalty and maximize lifetime revenue.

By aligning strategies to industry-specific challenges and opportunities, businesses can balance customer acquisition and lifetime value, ensuring sustainable growth. good CAC depends on the industry and the Customer Lifetime Value (CLV). Ideally, the CLV-to-CAC ratio should be at least 3:1. For instance:

- If your CAC is $100, the customer should contribute at least $300 in lifetime revenue.

- In industries with lower profit margins, such as retail, a 2:1 ratio may be acceptable.

Achieving a good CAC often requires a combination of precise targeting, cost-effective marketing channels, and continuous optimization.

How to Calculate Average CAC

Calculating your Average Customer Acquisition Cost (CAC) is essential for understanding the effectiveness of your marketing efforts. The formula is simple yet critical:

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

For example:

- If you spend $10,000 on marketing and sales in a month and acquire 100 new customers, your CAC would be $100.

- Ensure all costs are included, such as advertising expenses, salaries of marketing and sales teams, and tools or software subscriptions.

Customer Acquisition Cost Calculator

Using a customer acquisition cost calculator simplifies the process of tracking and analyzing CAC. These tools can:

- Incorporate additional metrics like CLV to provide a comprehensive view of your business’s health.

- Help businesses simulate scenarios and forecast the impact of budget changes on CAC.

To provide more clarity, let’s explore a detailed comparison of how businesses in various industries apply this formula:

- eCommerce: These businesses often break down their marketing expenses into categories like paid ads, influencer partnerships, and seasonal campaigns. For instance, a niche clothing brand might spend $5,000 on a holiday ad campaign and acquire 200 customers, resulting in a CAC of $25 per customer.

- SaaS: SaaS companies, especially those offering free trials, may calculate CAC by accounting for costs like content marketing, webinars, and free trial software maintenance. A SaaS company spending $20,000 on digital marketing to acquire 40 paying customers would face a CAC of $500.

- Healthcare: Clinics and hospitals calculate customer acquisition costs by including patient outreach, local SEO efforts, and educational content creation. For example, a healthcare provider might spend $15,000 on digital campaigns in a quarter to gain 50 new patients, yielding a CAC of $300.

- Mobile Apps: App developers consider both app store optimization and paid advertising. A gaming app spending $3,000 on ads and acquiring 1,500 downloads calculates a CAC of $2 per install.

- Education: Universities calculate CAC by including costs for virtual open days, alumni outreach, and targeted digital ads. Spending $50,000 to attract 100 new students results in a CAC of $500.

- Travel and Tourism: Travel agencies include influencer marketing, experiential ads, and social proof in their cost breakdown. A luxury travel brand might allocate $30,000 to marketing and gain 150 bookings, leading to a CAC of $200.

- Retail: Retailers often focus on conversion rate optimization to calculate customer acquisition costs. For instance, spending $4,000 on social media ads to acquire 400 customers results in a CAC of $10.

- Financial Services: Financial firms include content creation, customer onboarding costs, and webinars. A fintech startup spending $25,000 to gain 100 customers would report a CAC of $250.

- Real Estate: Real estate businesses consider VR tours, digital ads, and open house events. Spending $10,000 on these efforts and closing 20 property deals results in a customer acquisition cost of $500.

- Hospitality: Hotels and restaurants often integrate loyalty programs into CAC calculations. Spending $10,000 on email marketing and acquiring 100 repeat guests leads to a CAC of $100.

By applying the CAC formula within the context of specific industries, businesses can identify areas for cost optimization and align their strategies with measurable goals. Using real-world examples makes the concept relatable and actionable, ensuring a broader audience finds the information valuable.

The formula for customer acquisition cost is straightforward:

CAC = Total Marketing and Sales Expenses / Number of New Customers Acquired

For example:

- If you spend $10,000 on marketing and sales in a month and acquire 100 new customers, your customer acquisition costs would be $100.

- To get an accurate calculation, include all costs, such as ad spend, marketing team salaries, and software tools.

Businesses can use CAC calculations to measure the effectiveness of individual campaigns and allocate budgets more effectively.

What is a Standard CAC?

There is no universal “standard” CAC, as it varies by industry, company size, and customer demographics. However, understanding industry benchmarks can provide valuable insights. For example:

- SaaS companies typically have higher CACs due to extended sales cycles.

- Retail businesses may achieve much lower CACs due to simpler and faster purchase decisions.

Tracking CAC trends over time can also help identify areas for improvement.

Average CAC for Startups

Startups often face higher CAC initially as they build brand awareness and establish trust. On average:

- Startups in SaaS or eCommerce may experience CAC ranging from $100 to $500.

- Startups targeting niche markets or high-value customers may see even higher costs.

Startups can effectively manage customer acquisition costs by focusing on organic growth strategies and partnerships and leveraging existing customer networks.

Average Customer Acquisition Cost (CAC) for SaaS

The average CAC for SaaS companies ranges between $200 and $1,000. Key factors include:

- Length of the sales cycle: Enterprise SaaS products tend to have longer cycles.

- Marketing channel effectiveness: Email campaigns, paid ads, and webinars are common in SaaS marketing.

Reducing customer acquisition costs in SaaS often involves improving the conversion rates of free trial users and focusing on customer retention.

Customer Acquisition Cost Benchmarks & How to Improve

To improve CAC, businesses can:

- Optimize Marketing Campaigns: Use A/B testing to identify the best-performing ads and messages.

- Focus on Customer Retention: Encourage repeat purchases or subscriptions to maximize CLV.

- Leverage Automation: Automate email campaigns and lead nurturing to reduce labor costs.

- Diversify Channels: Experiment with organic content, partnerships, or affiliate marketing to lower dependency on paid ads.

Digital Marketing Services in DiMarketo

DiMarketo, a premier digital marketing agency in Dubai, specializes in providing complete marketing services customized to meet the diverse needs of businesses. With expertise in:

- Content Marketing

- SEO

- Performance Marketing

- Google Ads

- CRO

- Social Media Management

Our expertise spans content creation for websites and social media, Google Ads management, and performance marketing strategies to deliver measurable results. We specialize in conversion rate optimization (CRO) to turn website visitors into loyal customers. Whether you’re looking to increase engagement, improve ROI, or build a strong digital brand, DiMarketo combines innovation with proven techniques to help your business succeed in the competitive digital landscape.

Final Thoughts

Understanding the average CAC by industry allows businesses to benchmark their performance and implement strategies to improve efficiency. Whether you’re in eCommerce, SaaS, or any other sector, maintaining manageable customer acquisition costs relative to your CLV is essential for long-term profitability. By calculating your CAC accurately and leveraging benchmarks, you can uncover opportunities to optimize your marketing efforts and scale effectively.